The market for cryptocurrency exchange-traded funds (ETFs) turned historic as Hong Kong’s first-ever spot Bitcoin and Ethereum ETFs opened their morning session with a notable volume of $6.3 million.

This development means a lot in terms of cryptocurrency adoption within the Asia region, but it also indicates how much interest is from investors within the region regarding digital assets. This report goes into details on landmark ETFs and what they mean for the crypto market.

Hong Kong’s entrance to the ETF market

Hong Kong is known for being an international financial center with an active and dynamic landscape of investment. Spot Bitcoin and Ethereum ETFs in Hong Kong mean a significant step forward for the city’s financial markets, opening up new opportunities for investors to gain exposure to digital assets in regulated and transparent conditions.

Spot ETFs follows the movement of the spot price of the underlying asset, and investors can trade them on the traditional stock exchanges as any other security. Given the state of comfort this brings to both the retail and institutional investor in attempting to diversify their portfolios and toe dip into the growing cryptocurrency market, it’s an attractive option for the spot ETF.

Impressive Debut Morning Session

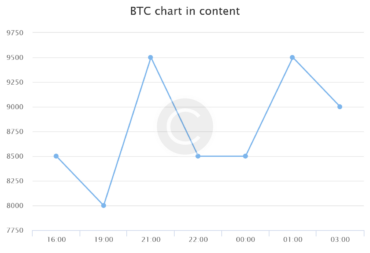

In its first morning session, Hong Kong’s spot Bitcoin and Ethereum ETFs smash over $6.3 million in total trading volume. A good start like this portends well for investor appetite for regulated investment products of this kind capable of exposing them to Bitcoin and Ethereum.

While still a slow start, the robust trading volume in the debut session still reflects pent-up demand for cryptocurrency ETFs in Asia and underscores the potential of the region as a growth market for digital assets. In fact, at a time when demand for cryptocurrencies is on the rise, the launch of spot ETFs in Hong Kong offers an easy and well-regulated channel for investors to take part.

Market Impact and Future Outlook

The spot ETFs on Bitcoin and Ethereum in Hong Kong, expected to launch soon, would significantly boost the cryptocurrency market while improving liquidity, price discovery, and mainstream acceptance. Such ETFs provide opportunities for investors to invest efficiently and in a regulated manner into Bitcoin and Ethereum and have the prospect of new capital inflows into the market with growth.

In addition, when successful Hong Kong spot Bitcoin and Ethereum ETFs are launched, this will open the door for similar products in other jurisdictions, making cryptocurrencies more accessible and reaching more investors around the world. With more regulatory clarity and institutional interest coupled with increasing demand for digital assets, the crypto ETF market is likely to expand pretty significantly over the next few years.

Conclusion