With resilience, growth, and remarkable features, Bitcoin managed to shoot above the $60,000 level to set yet another record high for the world’s most popular cryptocurrency. The move is but another leg in the rally that delineated the cryptocurrency markets to set up for a push further.

A Breakthrough Moment

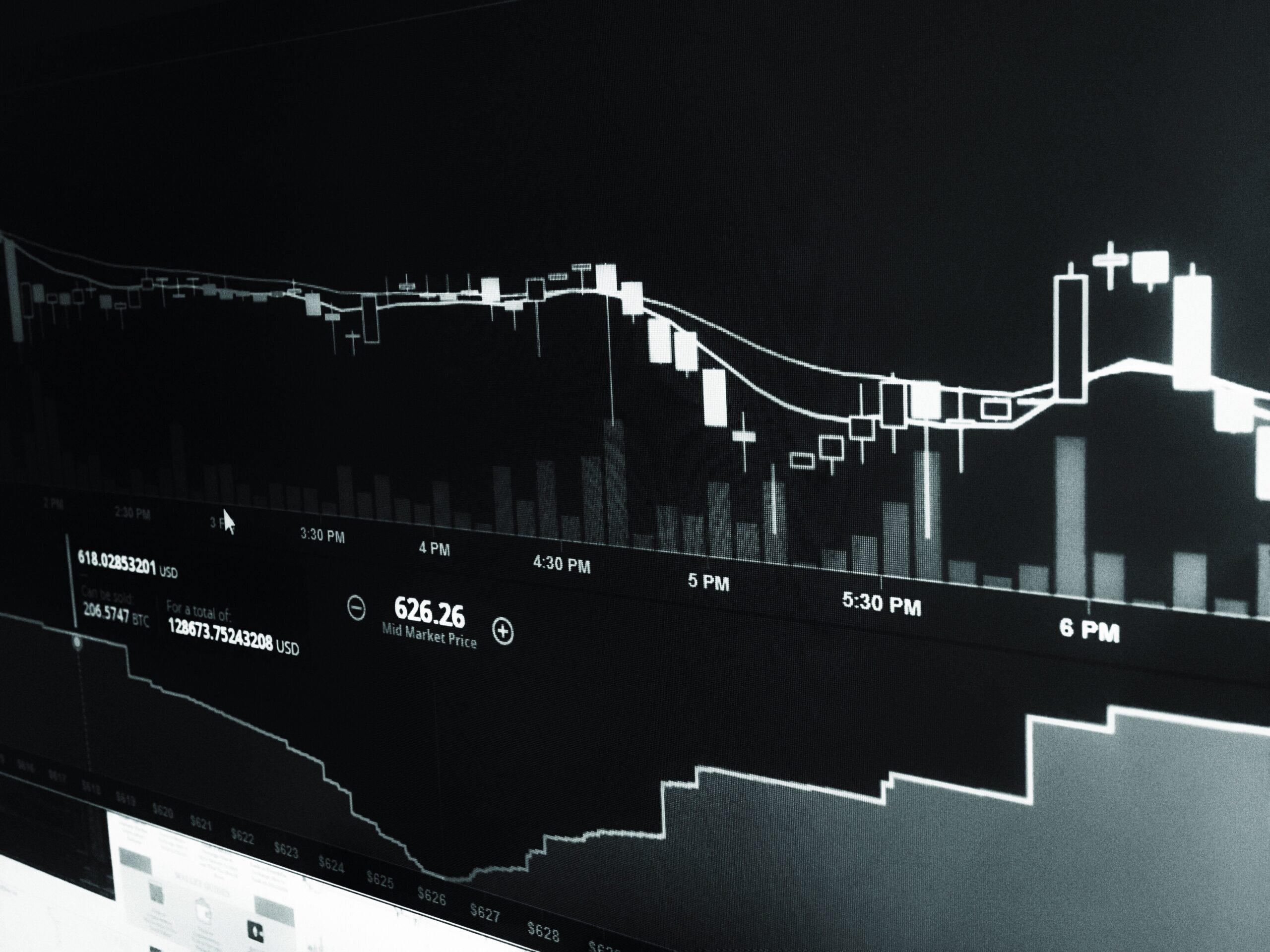

This recent upswing for the cryptocurrency is marked on [specific date] as its surge in price went far above the $60,000 level. This, numerically speaking, then becomes a rebound way higher compared to the past dips and documents how the cryptocurrency has been strong lately. While this takes place before a new breakout, one factor sustaining the trend would be strong investor faith coupled with a rise in institutional interest in digital assets.

Factors Driving the Uptrend

- Institutional Investment: Increasing interest from institutional investors is one of the most vital factors contributing to the push of Bitcoin prices. Big financial institutions and corporations have shown faith in the cryptocurrency with time by investing huge sums of money and involving Bitcoin in their business as part of its use.

- Market Sentiment: Good news and developments in the space, such as more clarity in regulations, progress made with blockchain technology, and increased adoption from both retail and institutional investors, have garnered a positive market sentiment.

- Technological developments in the durability of the technology behind bitcoin, such as improvement of the Lightning Network and the improvement in scalability, will be continuous. These developments are expected to push transaction speed higher and cost lower, thus making the use of bitcoin more pertinent to everyday use.

- Global Economic Factors: And in cooperation with the general economic environment. Worries on inflation, economic instability, and geopolitical threats have led investors to seek refuge in alternative assets. In this sense, Bitcoin is the clear preference for these investors who want to escape from defaults having to do with much more generic financial risk.

Market Reactions

The cryptocurrency market has reacted positively to the price explosion that Bitcoin recently saw, and similar interest has not been wanting in altcoins and other digital assets either. The overall sentiment that Bitcoin’s performance inspired was one of optimism and vibrancy within the cryptocurrency community.

What’s Next for Bitcoin?

As Bitcoin continues to garner more applause, market watchers and observers are on the keen lookout for where it will see itself heading. Key areas of focus will be on potential resistance levels, upcoming regulatory features, and broader economic indicators that can impact the cryptocurrency market.

Investors need to keep in perspective that this whole volatility of cryptocurrencies is basically natural with disruptive technology. How Bitcoin maintains its upward trend will entirely depend on what the prevailing sentiments are in the market and the external economic environment.

Conclusion

Bitcoin’s break into the $60,000 level testifies not only to its growing acceptance but also to the growing confidence on the part of investors in digital assets. The more mature the cryptocurrency marketplace becomes, the more Bitcoin hogs the limelight, vibrant and volatile as this monetary topography is. With recent benchmarks put on the table, all will now regard Bitcoin as it navigates above the thrown gauntlet holding both challenges and opportunities.